Anybody in Calgary looking to buy their first home is watching interest rates closely. If you’re not, now is the time to start. Mortgage rates have a huge impact on what you can afford—and whether it makes sense to lock in now or wait.

This month’s inflation report offered some hopeful news, but not enough for economists to believe the Bank of Canada (BoC) will rush to cut rates on September 17th. Let’s break down what this means for first-time buyers—and everyone else.

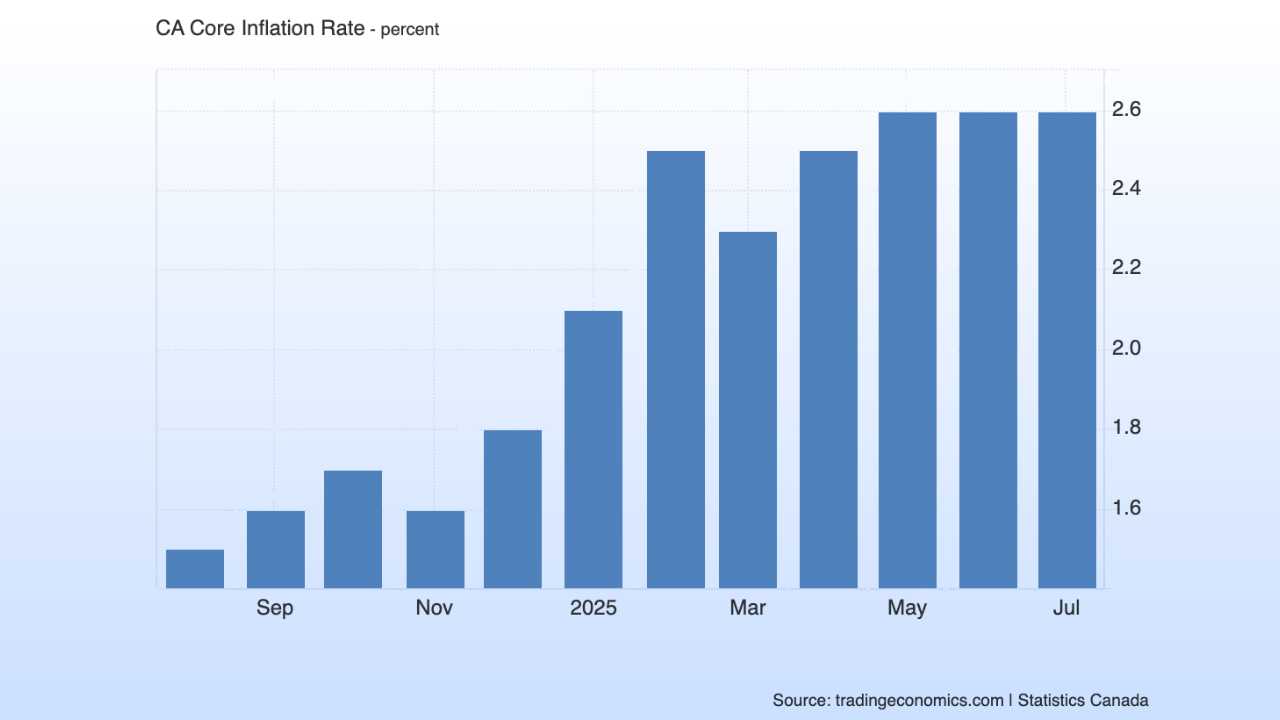

Inflation: Cooling, But Not Cold Enough

In July, Canada’s inflation eased to 1.7%, down from June’s 1.9%. That sounds good, but the Bank of Canada doesn’t just look at headline numbers. It pays closer attention to “core” inflation, which excludes volatile items like food and gas.

Those numbers stayed sticky:

- Customer Price Index-trim: 3.0% (unchanged)

- Customer Price Index-median: 3.1% (slightly higher)

Since the BoC’s comfort zone is around 2%, we’re still above target. Economists say this stability makes it unlikely the Bank will cut rates in September—unless the next inflation report (due the day before the decision) shows a big surprise.

Inflation Across the Border

While Canada is holding steady, the U.S. is seeing rising price pressures. U.S. inflation stayed at 2.7% in July, but “core” inflation climbed higher, partly due to tariffs and supply chain costs.

If U.S. bond yields rise because of this, Canadian bond yields—and fixed mortgage rates tied to them—often follow. That’s why Calgary buyers could see fixed rates edge higher, even if the BoC doesn’t change its own rate.

Your Mortgage in Calgary

- Fixed Rates: Right now, three- and five-year fixed rates are sitting close together. Economists say five-year fixed terms might offer slightly better long-term value if you want predictability.

- Variable Rates: These are still attractive but come with volatility. The BoC is expected to cut eventually, just maybe not in September. If you can handle some uncertainty, variable could save you money over time.

TLDR

Even if rates feel uncertain, your best move is to get pre-approved with a mortgage broker now. A pre-approval locks in today’s rate for up to 120 days, protecting you if rates go up but still allowing you to take advantage if they drop.

In Calgary’s competitive market—where affordability is already better than in Toronto or Vancouver—this can make all the difference when you’re ready to make an offer. Don’t wait for the “perfect” interest rate. Inflation is cooling but not fast enough to guarantee cuts in September, and U.S. trends could push Canadian fixed rates higher in the meantime.

If you’re a first-time buyer, the smartest step you can take right now is to connect with a trusted mortgage broker, like me, who can help you compare options, lock in a rate, and guide you through Calgary’s housing market with confidence.