Canada’s big banks reported their third-quarter results last month. TD Bank and RBC both posted strong profits, but beneath the headline numbers are signals of rising financial stress among Canadian households. For current and soon-to-be home owners in Calgary, these insights matter because they shed light on where the housing and mortgage markets may be heading.

TD’s Results in Brief

TD Bank returned to profit this quarter with an adjusted net income of $3.9 billion, up 6 per cent from last year. Canadian personal and commercial banking led the results, supported by loan and deposit growth.

However, TD also reported that mortgage delinquencies inched up to 0.13 per cent, compared with 0.09 per cent a year ago. While still historically low, this trend shows that more homeowners are struggling as they renew at higher rates. Variable-rate borrowers in particular have seen their payments rise, and when their loans reset, amortization schedules shorten again, leading to higher monthly costs.

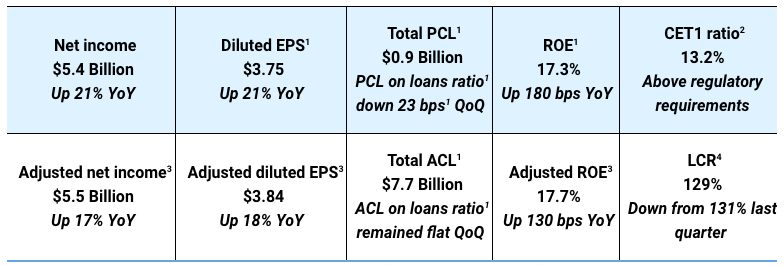

RBC Earnings and Mortgage Stress in Major Markets

RBC, Canada’s largest bank, reported record earnings in the same period. Adjusted net income rose to $5.5 billion, up 17 per cent year-over-year, with personal banking contributing strongly.

But the bank also highlighted rising impairments in its mortgage portfolio. Delinquencies in mortgages 90 days past due climbed to 0.31 per cent, up from 0.24 per cent a year ago. The increase is most pronounced in the Greater Toronto Area, where delinquency rates rose to 0.42 per cent from 0.27 per cent, and in Greater Vancouver, where the rate moved to 0.27 per cent from 0.20 per cent.

This shows that even in the country’s most robust housing markets, borrowers are finding it harder to keep up with payments. While RBC maintains strong capital ratios and most borrowers hold significant equity, the upward trend in arrears signals growing financial pressure.

Why This Matters for Calgary Buyers

For buyers in Calgary, the trends at TD and RBC point to a few key takeaways:

-

Renewals at higher rates are stressing households across the country, even in stronger markets like Toronto and Vancouver.

-

Banks are building higher provisions for credit losses, reflecting expectations that more borrowers could fall behind.

-

Mortgage growth remains steady, but lenders are watching household balance sheets closely.

Although Calgary’s housing market differs from Toronto or Vancouver, the same pressures apply: borrowing is more expensive, and planning for future renewals is critical.

Planning Your First Mortgage in Calgary

Both TD and RBC continue to grow their mortgage businesses, offering options for new buyers. At the same time, the rise in delinquencies highlights the importance of choosing the right mortgage structure.

Working with a Calgary mortgage broker can help first-time buyers compare products across multiple lenders, understand the difference between fixed and variable rates, and plan for how payments may evolve in the years ahead. With many households already adjusting to higher costs, having expert guidance can make a meaningful difference.

Managing Your Existing Mortgage

If you’re already a homeowner and making your payments has become a struggle, here are three things I recommend you do:

-

Talk to your lender right away – Many banks will work with you to adjust payments, offer temporary relief, or extend your amortization so monthly costs are lower.

-

Explore refinancing options – Through a refinance with a mortgage broker like myself, you may be able to consolidate higher-interest debt, switch between fixed and variable rates, or restructure your loan for more manageable payments.

-

Review your budget and use equity carefully – Cutting non-essential expenses can free up cash, while tapping into home equity (through a HELOC or refinance) may provide short-term breathing room if managed wisely.

Looking Ahead

TD expects interest margins to remain steady, while RBC forecasts modest home price growth over the next few years. But with billions of dollars in mortgages set to renew in 2025 and 2026, banks anticipate ongoing pressure on Canadian households.

For Calgary buyers, this means opportunity still exists, but entering the market requires careful preparation. Exploring your options with me can help you navigate these changes with confidence.