Canada’s latest population numbers show growth slowing to just 0.2% in the second quarter on an annualised basis. This is the weakest pace since the pandemic and well below pre-pandemic norms. For Alberta home buyers, these trends matter—not just for housing supply and demand, but also for mortgage affordability.

Fewer Temporary Residents, Slower Growth

Statistics Canada data shows a net outflow of temporary residents. The number of international students fell by 137,000 and temporary workers by 44,000, offset only slightly by more asylum claimants. Overall, the share of temporary residents has edged down from a peak of 7.6% to 7.3%.

The federal government’s target is 5.0%, which would mean almost a million fewer temporary residents nationwide. Whether or not that goal is achievable, the trend is clear: population growth is slowing, and with it, housing demand may ease compared to the surge of recent years.

How Population Impacts Housing

For Alberta buyers, slower population growth can bring both opportunities and risks. On one hand, softer demand may take pressure off home prices and create more room for negotiation. On the other, if population growth slows too much, it could weigh on broader economic growth and limit housing market momentum.

Economists have noted that if population growth were to turn negative, it could offset some of the benefits of lower interest rates for the housing sector. That makes it all the more important for buyers to plan carefully before entering the market.

Economic Momentum and Interest Rates

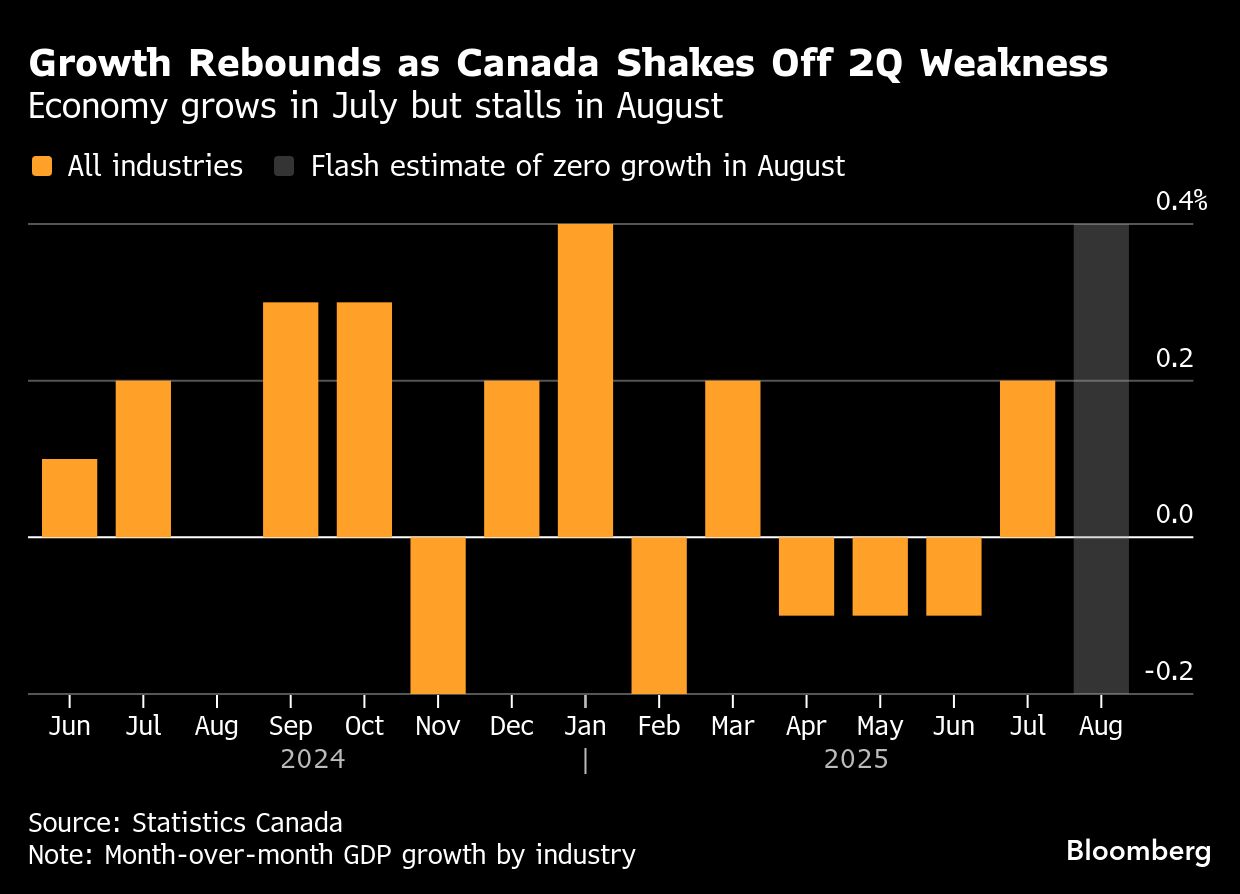

The Canadian economy showed modest growth in July, with GDP rising 0.2% month-over-month, but momentum remains weak. While some industries like auto manufacturing and energy saw gains, sectors exposed to U.S. tariffs struggled.

This mixed picture has economists predicting that the Bank of Canada may cut rates further this year to support growth. Lower borrowing costs are generally positive for home buyers, but they also highlight the importance of having expert advice to navigate changing conditions.

Why Home Buyers Benefit from a Mortgage Broker

In a market shaped by shifting population growth and uncertain economic momentum, Alberta home buyers can benefit from the expertise of a mortgage broker. A broker can:

-

Monitor rate changes and ensure you secure the best possible mortgage terms

-

Help you understand how broader economic and demographic shifts impact affordability

-

Provide access to multiple lenders, giving you more choice and flexibility

Even as Canada avoids recession and begins to rebound in the third quarter, the interplay between population growth, housing demand, and interest rates will continue to shape Alberta’s market.

For home buyers, working with a mortgage broker means you don’t have to make sense of all this on your own. It’s about having a partner who can help you navigate economic uncertainty, secure the best rates, and protect your investment for the long term. Reach out to me today!