For many Albertans, the dream of home ownership is stronger than ever, but rising prices and high interest rates make the decision between renting and buying more complicated. While buying allows you to build equity, renting provides flexibility and fewer upfront costs. The key is deciding which option fits your financial situation and lifestyle today—and into the future.

The Case for Renting

Some financial experts argue that renting can be a smart long-term option. Monthly rent is often cheaper when you factor in all the costs of ownership. Beyond your mortgage, home ownership comes with added expenses like property taxes, higher insurance and utilities, repairs, and ongoing maintenance.

For those who value mobility, renting makes sense. If your job or personal circumstances change, you can move without worrying about selling a property. Renting can also reduce stress since landlords, not tenants, are responsible for major repairs.

The Case for Buying

On the other side of the debate, many realtors and financial experts believe that renting long-term comes at a cost. Renters can easily spend over a million dollars in their lifetime with nothing to show for it. Homeowners, on the other hand, build equity with every mortgage payment and can benefit from future price appreciation.

Homeownership also comes with advantages like stability, personalization, and the ability to borrow against your home equity when needed.

Lifestyle and Long-Term Goals

Financial considerations aside, lifestyle plays a big role in the rent-versus-buy decision. Renting is ideal if you value flexibility, travel frequently, or aren’t ready to settle in one location. Buying makes more sense if you want stability, the freedom to personalize your space, and the chance to grow your wealth through property ownership.

If you’re uncertain about your long-term plans, renting might give you the breathing room to figure it out. But if you’re confident you’ll stay in Calgary and can afford the upfront costs, buying may be worth serious consideration.

Local Market Considerations in Calgary

Alberta’s housing market is on the upswing. Home sales and prices are expected to keep climbing, with Calgary leading the way due to strong population growth and limited housing supply. For buyers who can commit to staying in Calgary for at least eight to ten years, buying a home could provide a solid financial foundation.

At the same time, Calgary’s rental market is tightening, with rents increasing as demand outpaces supply. For many renters, this means less certainty about long-term housing costs.

Calgary Case Study

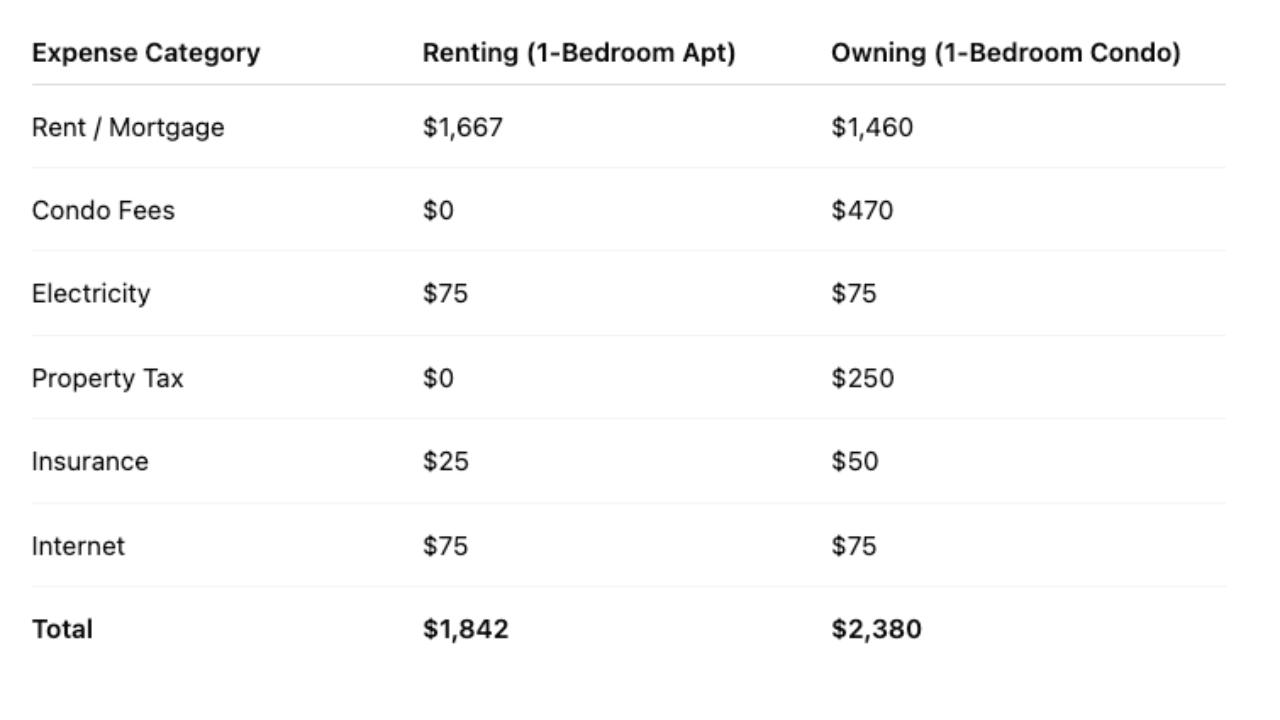

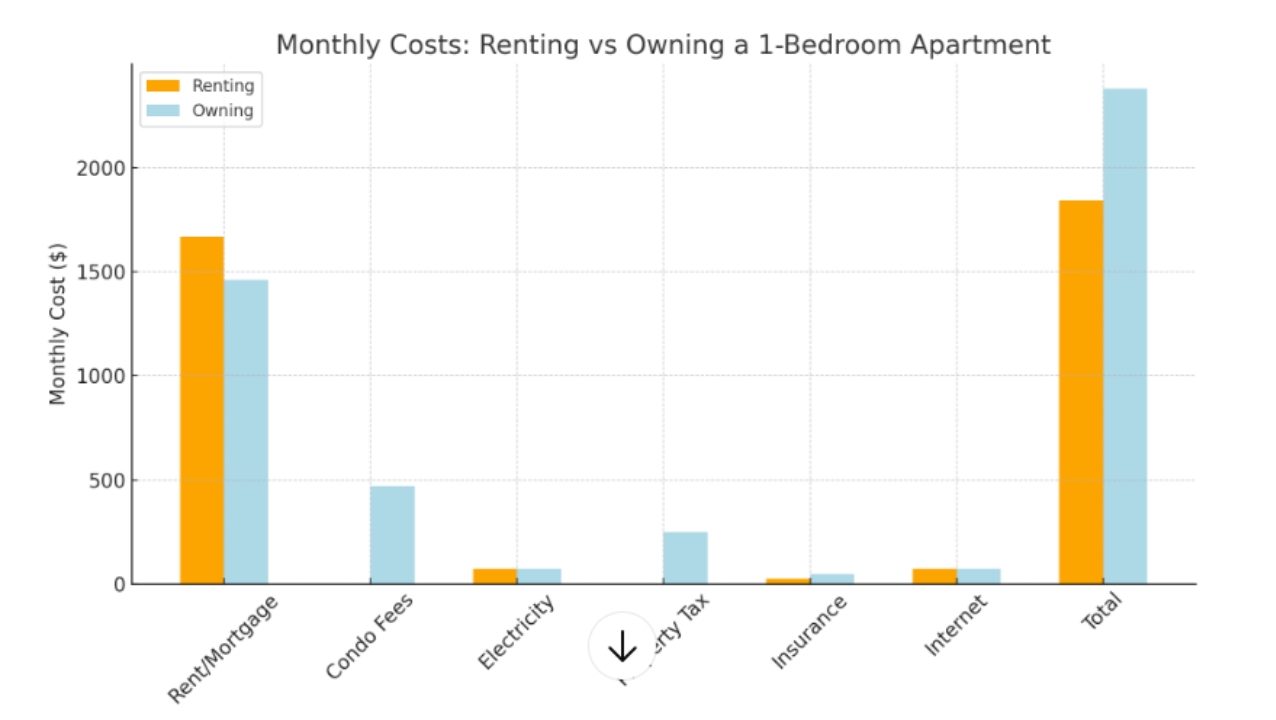

Let’s put this into perspective with a comparison between a rented 1 bedroom apartment and a purchased 1 bedroom condo, both in Calgary. The total cost of renting would be about $1,842 each month, compared to a $335,000 condo with a monthly mortgage payment of $1,460.

For those of you who appreciate a visual representation (like me) here’s a bar graph.

The difference between these two scenarios is $538 a month, enough to be a determining factor for the average buyer. By renting, you save money in the short term. But what does the long run look like? Rent has typically increased about 3.5% each year and mortgage rates have been anywhere from 1.4% to 5.9% over the last 25 years.

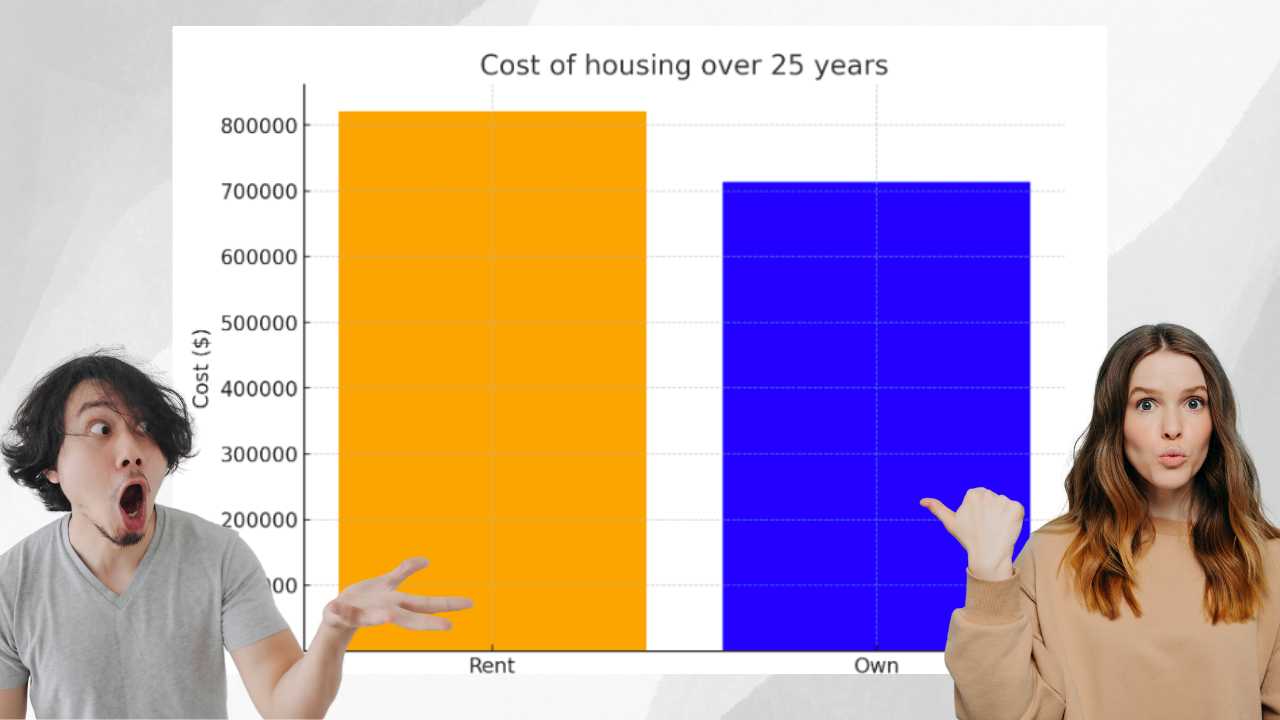

If you were to buy a 1 bedroom condo today in Calgary, 25 years from now you will have paid approximately a total of $714,000 for your home and be mortgage free. If, instead, you decided to spend the next 25 years renting, in 2050 you would be paying about $3,960 a month in rent and will have spent approximately $820,650 in the last 25 years.

By renting, not only will you end up spending $106,650 more compared to buying, and you’ll also miss out on the equity you could have built in your home. By 2050, the 1 bedroom condo you bought in 2025 for $335,000 is likely to sell for about $477,000 (based on the trends we have seen in housing prices over the last 25 years in Calgary); that’s $142,000 in equity.

Help for Calgary First-Time Buyers

If you’re leaning toward buying your first home, take advantage of programs like the First Home Savings Account (FHSA), the RRSP Home Buyers’ Plan, and the First-Time Home Buyer Tax Credit. These can help reduce the financial burden of purchasing your first home. It’s also important to work with a mortgage broker who understands the Calgary market. A broker can compare lenders, negotiate rates, and help you decide how much you can realistically afford.

There’s no universal answer to the rent-versus-buy question. Renting may offer peace of mind and flexibility, while buying can provide stability and the chance to build wealth over time. In Calgary’s fast-moving market, the right choice depends on your financial circumstances, lifestyle, and long-term goals.

If you’re a first-time home buyer wondering whether now is the right time to make the leap, I can guide you through the numbers and help you make a decision that fits your future.