This month has already brought a wave of headlines about Canada’s slowing economy — falling factory sales, weaker trade, and more signs that growth is losing momentum. On the surface, that sounds like bad news. But for Albertans thinking about buying their first home, there’s a silver lining: weaker economic data makes it more likely that mortgage rates will drop.

What’s Happening in the Economy

Manufacturing and wholesale sales both fell in August, the first decline in months. The government also announced a bailout for the lumber sector after U.S. tariffs hit Canadian producers hard, and Stellantis, a major automative manufacturer, said it’s closing its Brampton plant — a clear reminder that trade tensions are still hurting jobs and investment.

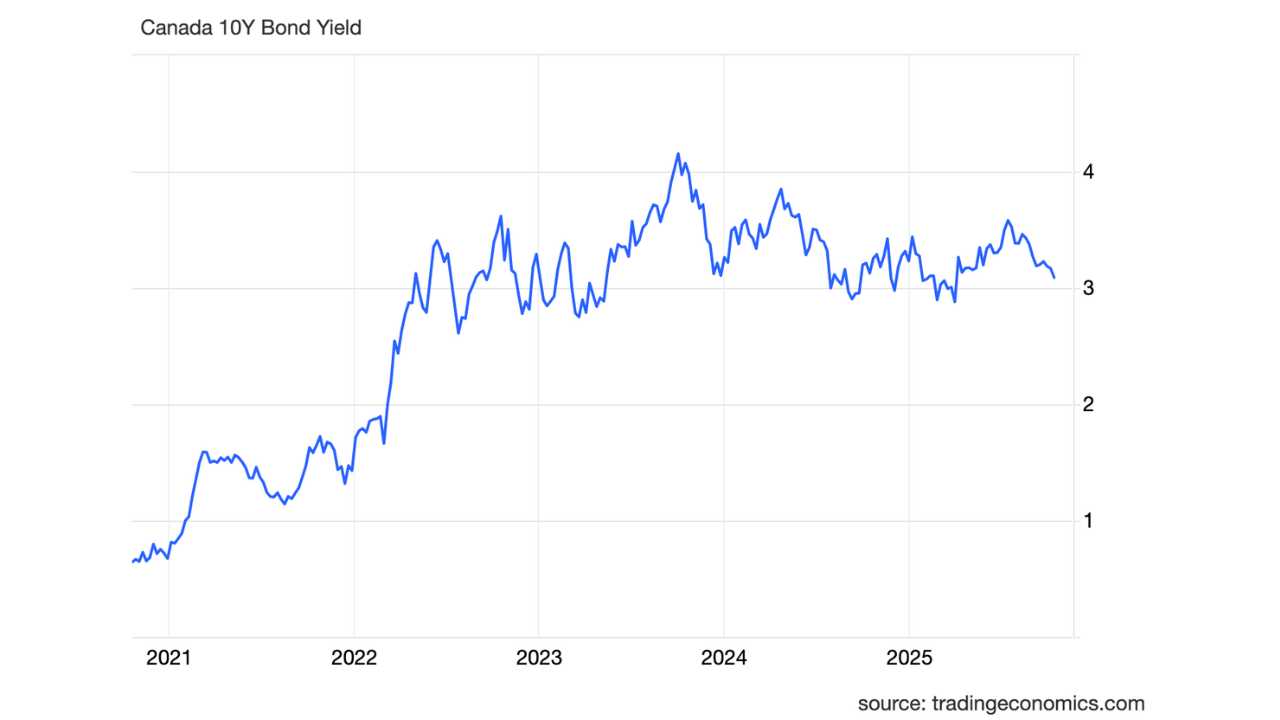

These developments made investors nervous, pushing Canadian bond yields lower. Since fixed mortgage rates are closely tied to bond yields, this drop could soon translate into better deals for borrowers.

Meanwhile, U.S. data is sending mixed signals — slower hiring and weaker demand for workers, but rising prices due to tariffs. That combination unsettled markets but reinforced expectations that central banks will need to cut rates to keep growth on track.

Mortgage Rates Could Ease

For now, all signs point to lower borrowing costs ahead. Canada’s 4-year swap rate — a key benchmark for fixed-rate mortgages — just hit a five-month low. The 5-year Canada Mortgage Bond yield also slipped, suggesting lenders could soon start trimming fixed rates.

Markets now expect a 62% chance the Bank of Canada will cut rates at its October 29 meeting. In the U.S., rate cuts are almost guaranteed before year-end. The direction is clear: both economies are softening, and policymakers are preparing to act.

What It Means for Homebuyers in Alberta

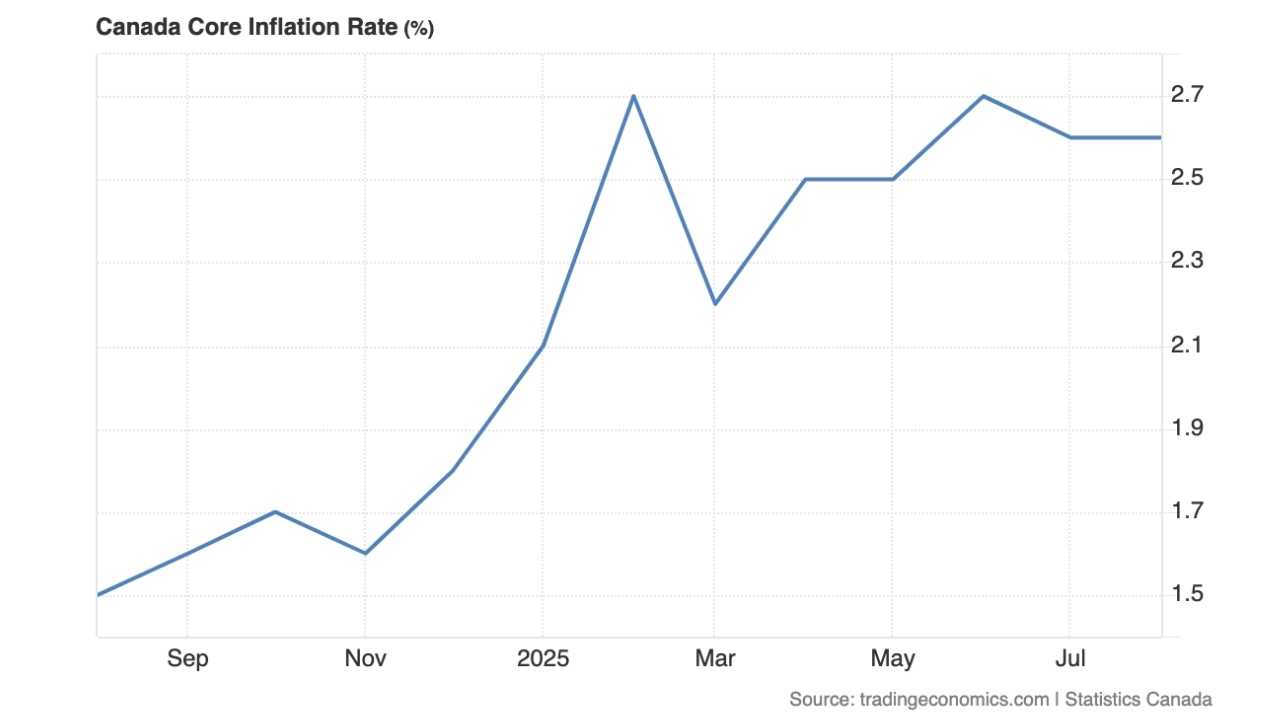

If you’re a homebuyer in Alberta, this could be a window of opportunity. The economy is sluggish, but mortgage affordability is slowly improving. Inflation has cooled from its highs, and analysts expect the Bank of Canada to lower rates by another 0.75% over the coming months.

That doesn’t mean it’s time to rush in blindly — rates can move quickly, and lenders don’t always pass along the full benefit right away. But it does mean there’s room to negotiate. A mortgage broker can help you take advantage of the shifting market, comparing rates from multiple lenders and finding flexible terms that match your financial goals.

Why a Mortgage Broker Makes a Difference

When the market is uncertain — as it is now — having an expert in your corner can make all the difference. Brokers have access to rate sheets and promotions that aren’t always available directly through banks. They also understand how to navigate tighter lending rules and can explain how rate changes affect your qualification and long-term costs.

For Alberta buyers, where regional markets can vary widely, a broker’s insight into local lenders and programs can help you save thousands over the life of your mortgage.

TLDR

Canada’s economy is slowing down, with factories and trade struggling and jobs not growing as fast. That could be good news for Alberta homebuyers because lower interest rates may be coming, which can make mortgages cheaper. Prices for homes and rents are starting to level off, giving buyers a better chance to get a good deal. Working with a mortgage broker can make it easier to compare lenders, find the best rates, and get a mortgage that fits your budget, even with the economy being uncertain. Have questions? Contact me to get no obligation answers!