Canada’s economy has taken a surprising turn, and it’s creating a new interest-rate outlook that matters for anyone buying a home, renewing a mortgage, or planning for 2026. Recent economic data shows a mix of soft consumer spending and strong job growth. That combination is changing how markets think the Bank of Canada will act in the years ahead.

For Alberta homebuyers and homeowners, understanding these shifts can help you make smart financing decisions. Here’s what the latest numbers mean and how working with a mortgage broker like me, Josh Tagg, can help you navigate today’s market.

A Strong Jobs Report Is Changing Interest Rate Expectations

The biggest surprise came from the November labour market data. Canada’s unemployment rate fell by 0.4% and job growth was better than expected. This is important because stronger job numbers usually mean the economy is healthier than expected.

Traders reacted immediately. Financial markets now fully expect the next move from the Bank of Canada to be a rate hike by late 2026. Just one day earlier, markets were pricing in the possibility of even more rate cuts. That shift shows how powerful this jobs report was.

Economists at CIBC say the data suggests the Bank of Canada’s cutting cycle is likely finished. The Bank itself has hinted for months that rates are “about the right level” unless inflation or growth takes a sharper turn.

But Not Everything Is Strong: Spending And GDP Are Still Soft

Even with stronger job numbers, other parts of the economy remain weak. Household spending has slowed significantly, with retail sales dropping in recent months. Consumption grew at just about 1.0% in the third part of the year, down from 4.5% in the second.

GDP also dipped in October, and Alberta felt additional pressure from events like the teachers’ strike.

These softer numbers would normally support more rate cuts, but the labour-market strength is shifting the balance.

U.S. Tariffs Add Another Layer Of Uncertainty

The ongoing trade dispute with the United States continues to weigh on Canada’s economy. Tariffs raise prices and slow exports, and the Bank of Canada has warned that this kind of structural damage limits how much it can help by lowering interest rates. If tariffs keep pushing prices up, the Bank has even less room to cut rates.

Canadians Are Split On What Comes Next

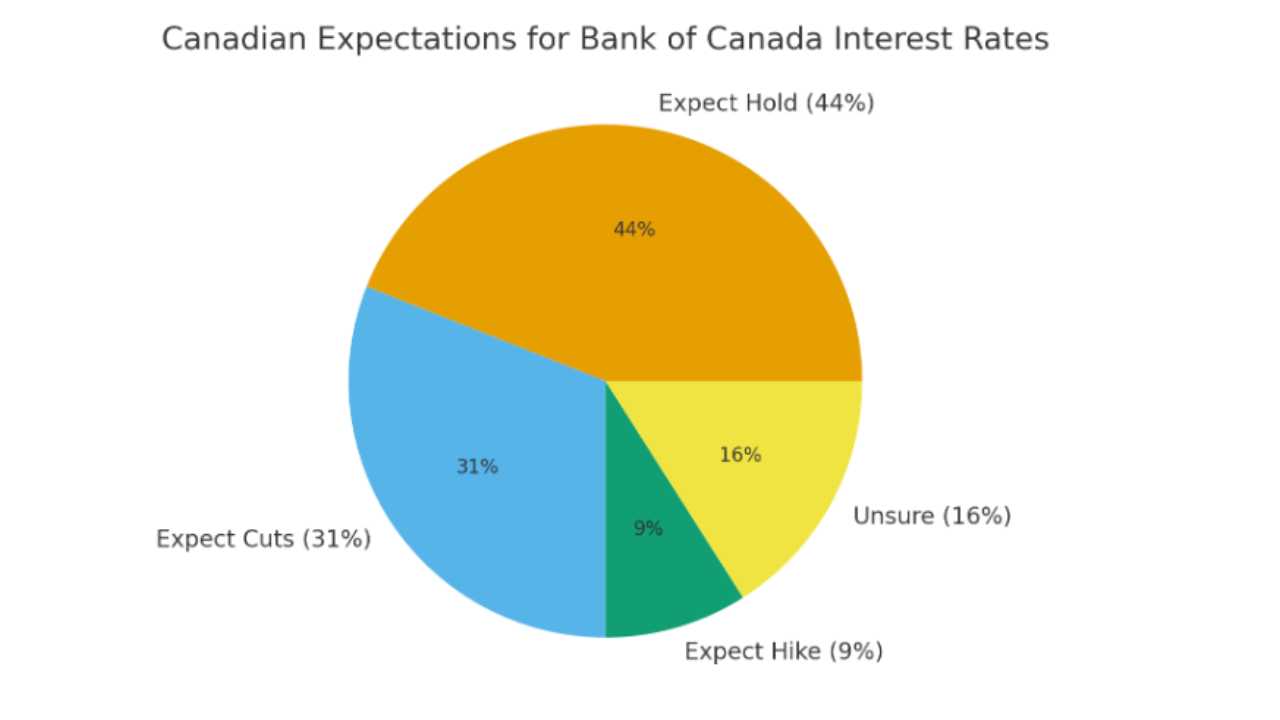

A new Nanos Research poll shows Canadian households are divided on where rates go next. Here’s how people responded:

When households expect rate cuts, many delay major purchases, which slows spending even further. Uncertainty tends to cool housing activity as buyers wait for clarity.

What This Means For Alberta Homebuyers

For Albertans, the key takeaway is simple: rates may not fall much from here. Even though parts of the economy are slowing, the strong job market suggests the Bank of Canada will stay cautious.

The next formal rate announcement is on December 10, and most economists expect no change.

If you’re buying a home, renewing your mortgage, or looking at pre-approvals for 2026, now is the time to get clear advice on your options.

Take Advantage of My Expert Advice

This is one of those moments when having an experienced mortgage broker on your side makes all the difference. Rate expectations are shifting quickly, and the best mortgage for you depends on more than just today’s numbers.

I help Alberta homebuyers understand:

• What current rate trends mean for fixed and variable mortgages

• How to protect yourself if rates rise sooner than expected

• Whether today’s market conditions make it better to lock in or stay flexible

• How to structure your mortgage to stay affordable even as the economy changes

Markets may be unpredictable, but your mortgage plan shouldn’t be. I keep clients informed, prepared, and confident—whether rates hold, fall, or rise. Contact me today!