The Bank of Canada has cut its key interest rate by 25 basis points today, bringing it down to 2.5%. For first-time home buyers in Alberta, this change could make entering the housing market a little more affordable for those choosing a variable rate.

Why the Bank of Canada Made the Cut

The decision comes as the Canadian economy faces significant challenges:

-

Canada’s GDP contracted in the second quarter, largely due to trade uncertainty and tariffs, with exports falling by 27%.

-

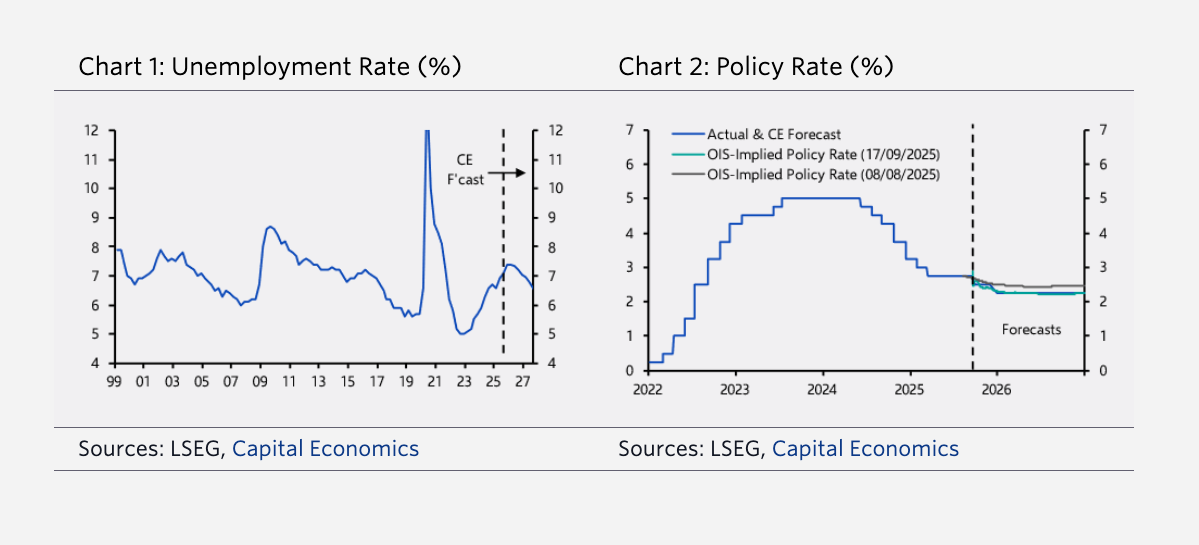

The unemployment rate climbed to 7.1% in August, reflecting more than 100,000 jobs lost in recent months.

-

Inflation pressures have eased, with August CPI coming in below the 2% target. The recent removal of retaliatory tariffs on U.S. goods also reduces future upward pressure on prices.

Governor Tiff Macklem explained that the governing council reached a “clear consensus” on the rate cut, aiming to balance risks while supporting growth.

What This Means for Calgary Buyers

For Alberta’s home buyers, the rate cut could mean:

-

Lower borrowing costs: A reduced policy rate translates into more favourable variable mortgage rates, which can lower monthly payments.

-

More purchasing power: With slightly lower variable interest rates, buyers may qualify for larger mortgages, opening up more options in Calgary’s market.

-

Relief in a tight market: With CMHC reporting a slowdown in housing starts, inventory remains tight, keeping prices high. Lower rates may help ease some of the affordability challenges.

The Bond Market and Fixed Interest Rates

While the Bank of Canada’s move directly impacts variable mortgage rates, fixed mortgage rates are more closely tied to government bond yields. As of this morning, the Canada 5-year bond yield sits at 2.706%, only slightly lower on the day. This modest change suggests markets are holding steady, waiting to see how the U.S. Federal Reserve responds in its own rate announcement at 2 p.m. EST.

For Alberta home buyers considering a fixed-rate mortgage, this means that while today’s cut is positive news, fixed rates may not shift significantly until the bond market reacts to broader North American monetary policy. The Fed’s decision later today could add more clarity.

Proceeding Carefully

While this cut is welcome news, the Bank of Canada has stressed it will move “carefully” with future changes. Policymakers are cautious about inflation risks and global trade uncertainties, which continue to affect economic stability.

For first-time buyers in Alberta, this means it’s a good time to explore your options, but also to plan strategically. Variable interest rates may not fall quickly or significantly beyond this point, and housing supply challenges remain in play.

How a Mortgage Broker Can Help

Navigating these shifts can be overwhelming, especially when you’re buying your first home. As a local mortgage broker, I can:

-

Compare rates across multiple lenders

-

Help you understand your borrowing power

-

Structure your mortgage to fit your budget and long-term plans

With rates moving lower, now is the time to connect with me. I can guide you through your options in Alberta’s competitive housing market.