Last week the Bank of Canada lowered its overnight rate and I’ve gotten several emails and text messages from customers asking if their rate is going to go down. If you have a fixed rate, the answer is:

Your lender, probably a bank, gave you either a fixed rate or a variable rate. Fixed rates are determined by bond yields and variable rates are determined by the Bank of Canada’s overnight rate. So if your mortgage has a variable rate, then yes, your rate may be about to go down, or already did recently.

What is the bond market?

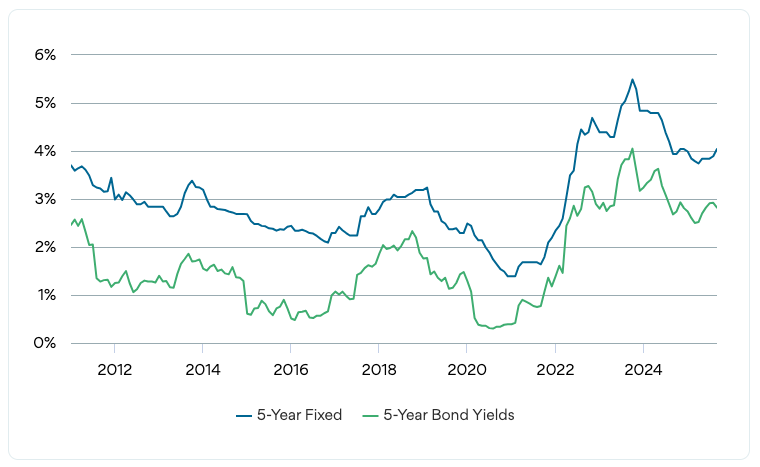

Fixed mortgage rates are determined by the bond market. In the simplest terms, a bond is money the government borrows from a person. Anybody can buy a bond and the government will pay it back to you with interest after a set period of time, such as 1, 2, 3, or 5 years. The money you make is called the bond yield. The chart below demonstrates 5 year fixed mortgage rates compared to the 5 year bond yields over the last 15 years in Canada.

Fixed Rates

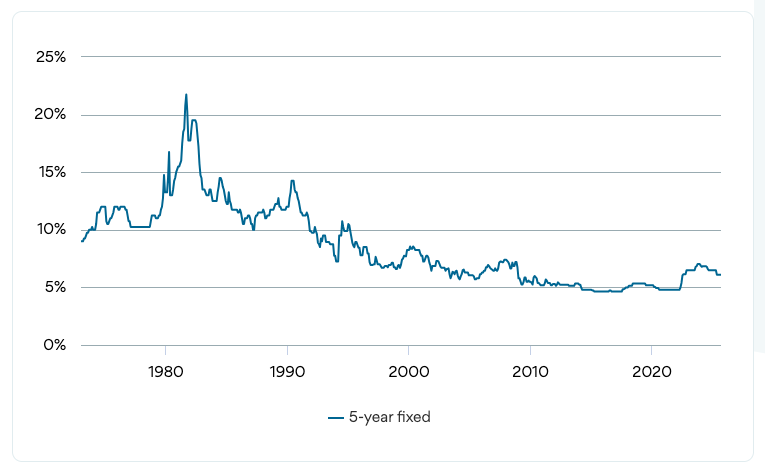

Once your lender has approved your fixed rate, it will stay the same for the entire length of your term. But how is that rate determined? Fixed mortgage rates rise and fall depending on bond yields. When yields are low, fixed mortgage rates are typically high. And when yields are high, fixed mortgage rates are typically low.

Variable Rates

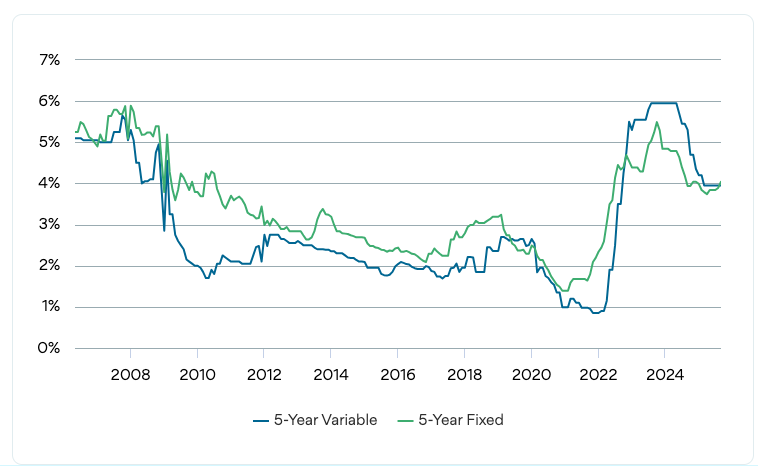

Variable rates, on the other hand, can change from day to day and there is no “locking in.” This rate is determined by your lender’s prime rate, which in turn is influenced strongly by the Bank of Canada’s overnight rate. Prime rates don’t move in lockstep with the overnight rate, so a bank may lower their interest rate in anticipation of the central bank lowering theirs. And they don’t always move the same amount.

When you choose a variable rate, your bank starts by calculating your rate margin (based on your credit, debt levels, income and other factors). Then they apply this margin to their prime rate to give you your specific mortgage rate. For example, prime + 1% or prime -0.5%.

What is the overnight rate?

Banks in Canada borrow money from each other every day, and they don’t do it for free —they charge interest. Canada’s central bank, the Bank of Canada, sets that rate and calls it the overnight rate. (It’s also referred to as the benchmark rate and the policy interest rate.) The BoC uses this rate to influence inflation—how quickly the cost of everything increases. If inflation is getting too high, the Bank will increase the overnight rate to bring it back down. If inflation is getting too low, the Bank will decrease it to make spending more affordable.

Why do banks borrow from each other?

Banks need to have a certain amount of cash available for their customers to withdraw, and they’re required by regulations to hold a certain percentage of their customer deposits as reserves. To make sure they’re following these regulations, banks borrow money from one another at the end of each business day. Hence the term, “overnight” rate.

Fixed vs variable rates

Which is better? That depends on what you want. A fixed mortgage is good if the rates are low and you’re anticipating them getting higher in the years ahead, and if you want the reliability of a consistent payment month over month.

Variable rates, on the other hand, have historically been lower than fixed rates. If you expect rates to decline in the coming years, this type of mortgage is a good bet. However, you also run the risk of paying higher rates if the market shifts in that direction. You’ll also have to plan accordingly for your payments to be different every month.

If you currently have a variable rate mortgage, have a look at your rate to find out exactly what it is and compare it to what it was over the last few months. If your rate hasn’t gone down yet you can expect it to very soon. And if you have a fixed mortgage, have a look at your rate and compare it to rates currently being offered by lenders. It may be worth it to refinance at a lower rate. If you don’t want to go to all that work, give me a shout, I’ll do it for you!