As we move into 2026, I’m getting the same questions from Alberta buyers and homeowners almost every day: Is now a good time to buy? Will rates drop more? Are prices about to jump again?

After several unpredictable years, the Canadian housing market is starting to feel more balanced. That’s good news, especially for people who felt locked out during the peak of high rates. Below is how I’m reading the latest forecasts, and what they realistically mean if you’re buying, renewing, or already own a home in Alberta.

A Steadier Housing Market In 2026

Most economists and real estate firms expect 2026 to bring a gradual recovery, not a surge. Home sales across Canada are forecast to rise modestly, with price growth staying fairly contained.

The Canadian Real Estate Association is forecasting national home sales to increase by about 7.7 percent in 2026, with average prices up just over 3 percent. Other major firms, like Royal LePage and RBC, are also calling for modest price changes rather than dramatic gains.

What’s important here is the tone. Demand didn’t disappear over the last few years, it was delayed. Many buyers simply waited on the sidelines while rates were high. Now that borrowing costs have come down from their peak, that demand is slowly returning, but affordability and supply are still limiting how fast the market can move.

What This Means Specifically For Alberta

Alberta continues to stand out compared to parts of Ontario and B.C. Our home prices are lower relative to incomes, and population growth remains strong as people move here for work and affordability.

While national forecasts average everything together, Alberta tends to perform better in balanced markets. We’re less likely to see sharp price drops, but also less likely to see runaway price growth. For buyers, that usually means more choice and less pressure to rush. For homeowners, it suggests stable values rather than sudden swings.

Interest Rates: Stability, Not Big Cuts

By far the biggest change heading into 2026 is the shift in expectations around interest rates. The conversation has moved from how fast rates might fall to how long they might stay where they are.

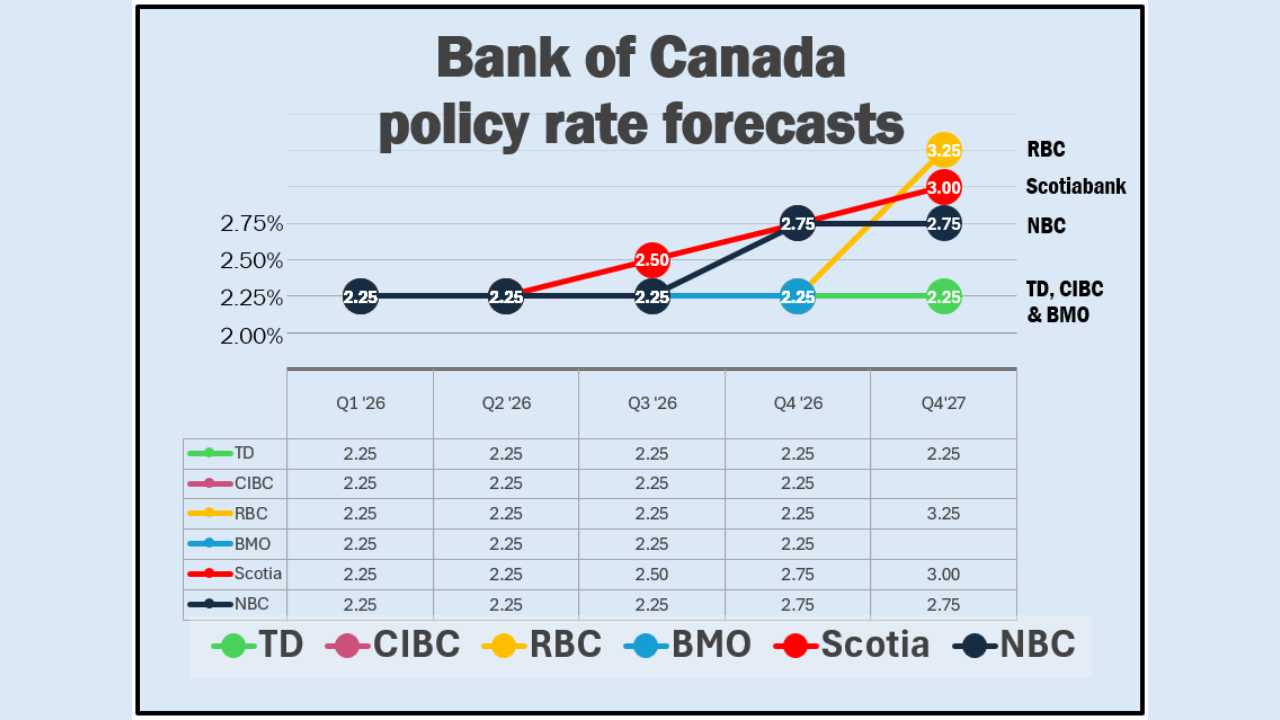

Most major banks expect the Bank of Canada’s overnight rate to sit around 2.25 percent through much of 2026. Some forecasts suggest rates could edge higher late in the year or into 2027, while others expect them to stay flat for longer.

For borrowers, this means a more predictable environment. Variable-rate mortgage holders have likely seen most of the relief they’re going to get for now. Fixed mortgage rates may not drop much further and could face upward pressure over time as markets look ahead to future tightening.

In short, 2026 looks like a year of rate stability rather than bargains.

A Quick Note On The U.S. And Global Markets

U.S. Federal Reserve meeting minutes show most officials still expect additional rate cuts there if inflation keeps easing, but they’re divided on timing. This uncertainty matters because global bond markets influence Canadian fixed mortgage rates.

At the same time, Canadian stock markets had a very strong year, driven largely by banks and resource companies. That strength supports overall economic confidence, but it doesn’t automatically translate into cheaper mortgages or higher home prices. For housing, rates and local supply still matter most.

What I’m Telling My Clients Right Now

If you’re waiting for dramatically lower rates or a major housing correction, most forecasts suggest you may be waiting a long time. The more realistic opportunity in 2026 is a calmer market where you can plan instead of react.

For buyers, this could be a window to purchase without extreme competition, especially if your job and finances are stable. For homeowners, it’s a good time to review renewal options early, understand your budget at today’s rates, and avoid assuming future cuts will save you.

If you’re new to Canada, this stability can actually be helpful. A slower market gives you time to build credit, save a down payment, and learn how the mortgage process works without feeling rushed.

Every situation is different, and forecasts are just that, forecasts. But overall, 2026 is shaping up to be a year where informed decisions matter more than perfect timing.

If you’re buying, renewing, or just trying to understand your options in Alberta, I’m always happy to walk through what these trends mean for your specific situation.