One of the most common questions I get from clients is: “How are fixed mortgage rates set?” It’s a fair question—after all, when you’re making a five-year financial commitment, it’s helpful to understand where that number comes from.

The simple answer? Bonds and Swap Rates.

Let’s break it down.

Option 1: Think GICs (or bonds)

If you’ve ever bought a GIC (Guaranteed Investment Certificate) at your bank—for one year, two years, or more—you’ve contributed to the funding pool that banks use to lend out mortgages.

Banks take that money you deposit and lend it out at a higher interest rate in the form of a mortgage. The difference between what they pay you (in GIC interest) and what they charge the borrower (the mortgage rate) is how the bank makes money. Out of that margin, they also cover expenses like staff salaries, mortgage commissions, overhead, and marketing.

This kind of setup, called matched-duration funding, works well for certain types of mortgages. For example, a 2-year GIC might help fund a 2-year fixed-rate mortgage. But that’s not the only way banks fund mortgages.

Option 2: Enter the World of Swaps

Sometimes, banks and mortgage lenders fund mortgages with floating (variable) money instead. But here’s the issue: they’re lending money at a fixed rate while borrowing at a floating rate. That creates risk. If interest rates go up, the cost of borrowing rises—but the mortgage payments stay the same. That squeeze cuts into their profits. And could even go as far as making them lose money on your mortgage.

To manage that risk, banks use a tool called an interest rate swap.

Here’s the simplified version of what happens:

-

The bank agrees to pay a fixed interest rate and receive a floating rate in return.

-

This “pay-fixed, receive-floating” swap allows the bank to turn a borrower’s fixed-rate mortgage payments into a stream of floating-rate income.

-

That way, even if variable rates rise, the bank is protected because the swap adjusts with the market.

In essence, swaps give lenders a way to lock in their own cost of funds while still offering you a fixed-rate mortgage. It’s financial wizardry, and it’s crucial—it helps banks manage billions of dollars with much lower interest rate risk.

Why the 4-Year Swap Rate Matters

The 4-year swap rate often raises eyebrows. “Aren’t most mortgages five years?” Yes, but swaps don’t always line up neatly with bond terms, and in Canada, the 4-year swap rate often acts as a benchmark for pricing many fixed mortgage products.

Swaps and fixed mortgage rates move very closely—like train tracks. We and lenders keep a close eye on it because it’s a key indicator of where rates are headed.

What About Bonds?

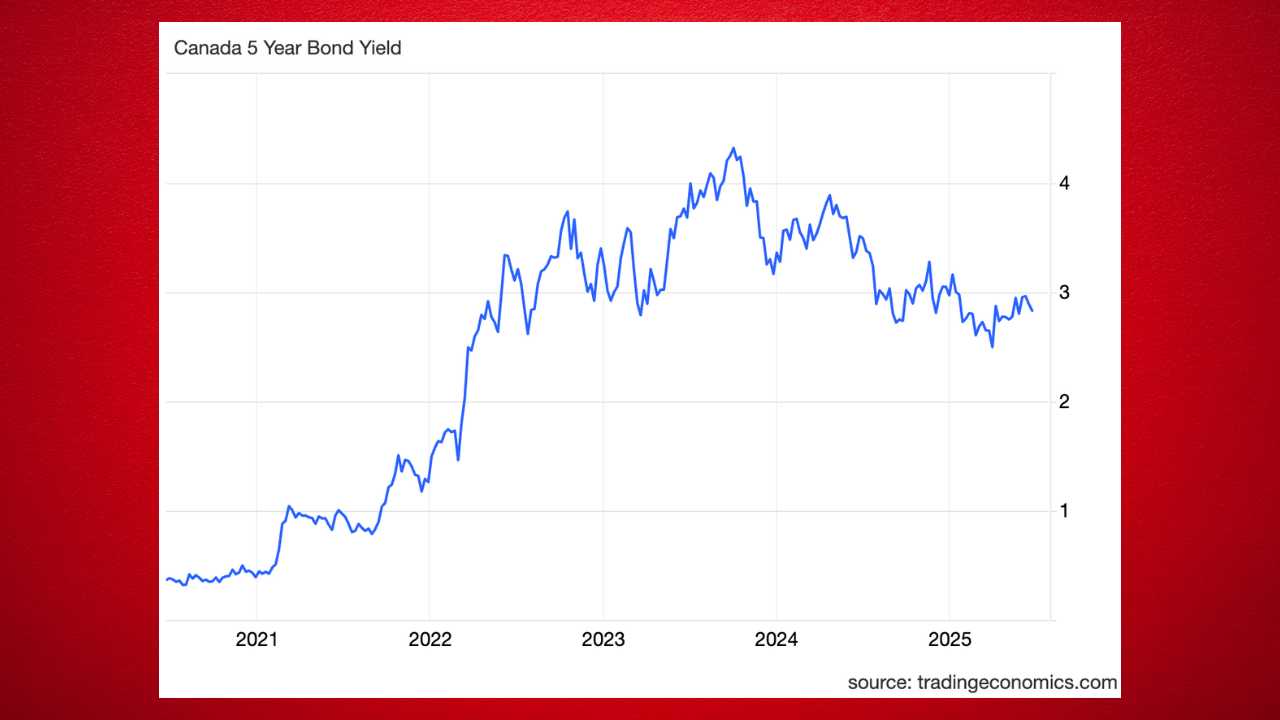

If you’re used to hearing that the 5-year Government of Canada bond yield is what decides fixed mortgage rates, you’re not wrong. It’s by far the most common tool used by many mortgage professionals. Why?

-

Bond data is everywhere—you can find it in seconds.

-

Swaps are more complex—not everyone understands how they work or where to find the data.

But here’s the catch: while bond yields are a decent proxy, they’re not always precise. Swap rates are often more directly tied to what lenders actually use when pricing your mortgage.

When you see a fixed mortgage rate, you’re seeing the product of a carefully balanced financial equation. It might be backed by simple GICs or hedged through complex swaps—but either way, lenders are constantly managing risk behind the scenes.

Understanding these mechanics gives you an edge when talking about mortgage rates—and why they move the way they do.

If you’re curious about where rates are going or want to dig deeper into swap pricing, let’s chat!