I’m Josh Tagg, a mortgage broker here in Alberta. One question I hear a lot from first-time homebuyers — especially people new to Canada — is this: What credit score do you need to buy a house? I’ll explain how credit scores work, why they matter, and what you can do to improve your chances of getting a mortgage in Alberta.

What Is a Credit Score in Canada?

In Canada, credit scores range from about 300 to 900. The higher the score, the more confident lenders feel that you’ll repay your debts on time. This matters because your credit score helps influence whether you get approved for a mortgage and the interest rate you’re offered.

Minimum Credit Score for a Mortgage

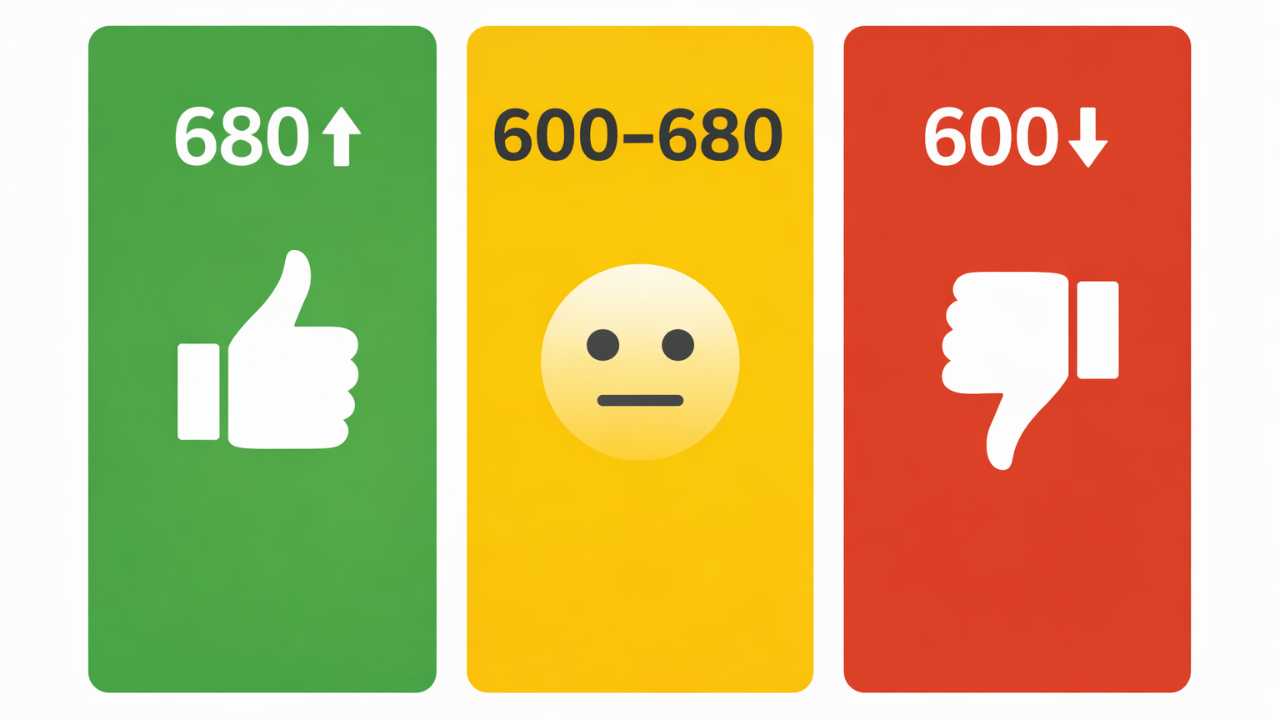

There isn’t one fixed number that all lenders use. Generally:

-

680 and up is considered a strong score for most traditional banks and gives you the best chance at approval with better interest rates.

-

600–680 may still get you approved, especially if other parts of your application (like income and down payment) are strong, but rates could be higher.

-

Some alternative lenders may look at scores below 600, but this usually means higher rates and larger down payment requirements.

In practical terms, I tell most of my clients that aiming for at least a 680 credit score gives you the best shot at qualifying for the most competitive mortgages in Alberta.

How Your Credit Score Affects Your Mortgage Rate

Your credit score doesn’t just help you get approved — it also influences the interest rate you pay. Borrowers with higher scores are typically offered lower rates because lenders see them as lower risk. Scores above about 760 will often qualify for the best rates available.

If your score is lower, you might still get a mortgage, but expect:

-

Higher interest rates

-

Less flexibility from some lenders

-

Potentially larger monthly payments over time

Other Things Lenders Look At

While credit score is important, it’s just one piece of the mortgage decision:

-

Your income and employment stability

-

The size of your down payment

-

Your debt-to-income ratio

-

Results of the mortgage stress test

-

Your credit report accuracy

Before applying, it’s a good idea to check your credit report for errors — mistakes could lower your score and hurt your approval chances.

Tips for Improving Your Credit Score

If you want to boost your credit before applying for a mortgage, here are some steps that work well:

-

Pay bills on time every month — payment history is the most important factor.

-

Keep credit card balances low — use less than about 30% of your available credit.

-

Don’t open too many new credit accounts in a short time.

-

Regularly check your credit report and fix errors.

Improving your score can take time, but even a modest increase can lower your interest rate and reduce your monthly mortgage payments.

My Advice

Your credit score is one of the most important numbers in the mortgage process. But it’s not everything — lenders look at your whole financial picture. If your score isn’t where you’d like it to be, don’t worry. With planning and time, you can build it up and improve your mortgage options.

If you have questions about your specific situation or want help figuring out where you stand, reach out. I’m here to help you make sense of the numbers and move confidently toward buying your home in Alberta.