Buying a home in Alberta often comes down to one big question: how much do I need for a down payment? If you’ve been told you need CMHC mortgage loan insurance, you might be wondering why. It’s often unexpected news I have to explain to first-time buyers and new Canadians.

CMHC mortgage loan insurance can sound complicated, but it’s actually one of the main reasons many Albertans are able to buy a home sooner instead of waiting years to save a 20% down payment. Here’s what you need to know.

What is CMHC mortgage loan insurance?

CMHC mortgage loan insurance, also called mortgage default insurance, is required in Canada when your down payment is less than 20% of the purchase price.

This insurance protects the lender, not you, if mortgage payments can’t be made. In return, lenders are willing to approve mortgages with smaller down payments, sometimes as low as 5%.

If your down payment is under 20%, your mortgage is considered a high-ratio mortgage, and insurance is mandatory.

In Canada, mortgage default insurance is provided by CMHC, Sagen, and Canada Guaranty. CMHC is the most well-known, which is why many people refer to all default insurance as “CMHC insurance.”

How mortgage loan insurance helps Alberta buyers

Without mortgage loan insurance, most buyers would need a full 20% down payment. In Alberta’s larger cities, that can mean saving well over $100,000 before buying your first home.

Mortgage loan insurance allows you to:

-

Buy a home with as little as 5% down

-

Access competitive interest rates

-

Enter the housing market sooner

-

Spread the insurance cost over your mortgage payments

For many buyers, especially first-time buyers and newcomers to Canada, this is what makes homeownership possible.

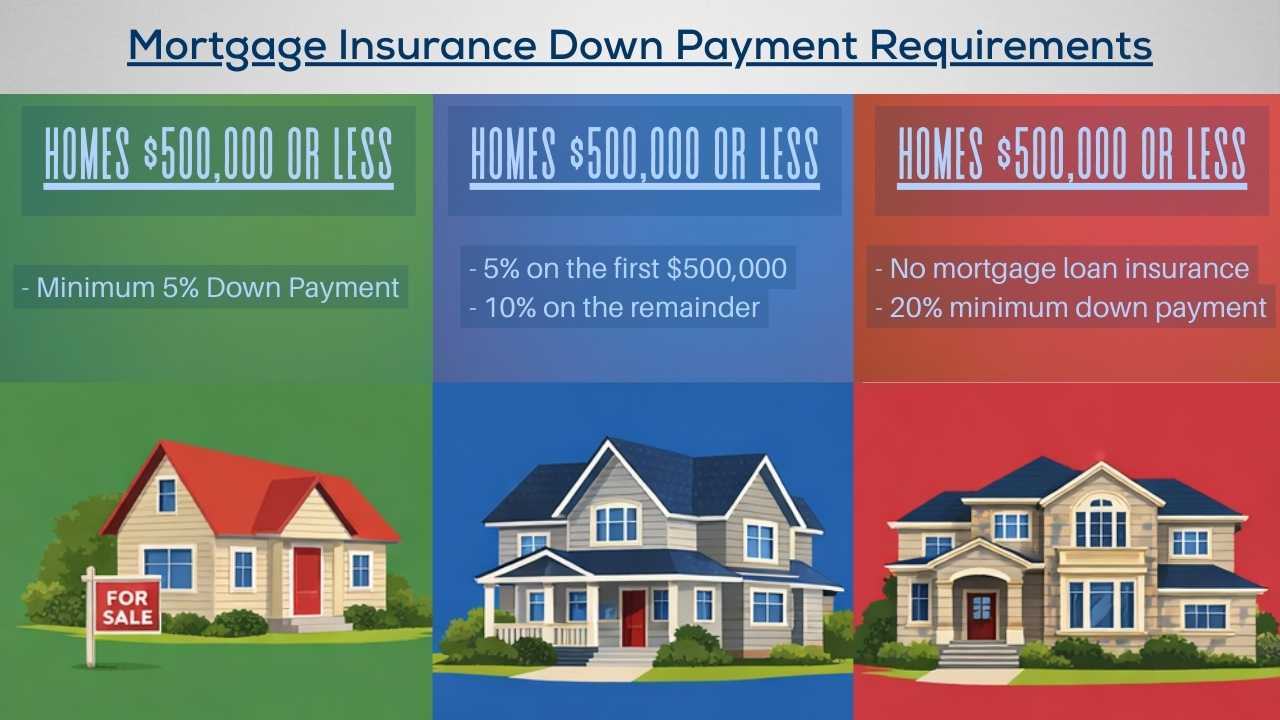

Minimum down payment rules in Canada

Your required down payment depends on the purchase price of the home.

- For homes priced at $500,000 or less you need a minimum down payment of 5%.

- For homes priced between $500,000 and $1,499,999, you need 5% on the first $500,000 and 10% on the remaining amount.

- For homes priced at $1.5 million or more, mortgage loan insurance is not available, and a minimum 20% down payment is required.

- These rules apply across Canada, including Alberta.

Example: how this works in real life

Let’s say you’re buying a $750,000 home in Alberta and you’ve saved $60,000.

Here’s the minimum required down payment:

- 5% of the first $500,000 = $25,000

- 10% of the remaining $250,000 = $25,000

- Total required = $50,000

You meet the minimum, but your down payment is still under 20%, so mortgage loan insurance is required.

What is the mortgage loan insurance premium?

The insurance premium is the cost of mortgage loan insurance. It’s calculated as a percentage of your mortgage amount, based on how much you put down. In general, the smaller your down payment, the higher the premium. Premium rates typically range from about 0.6% to 4.0% of the mortgage amount.

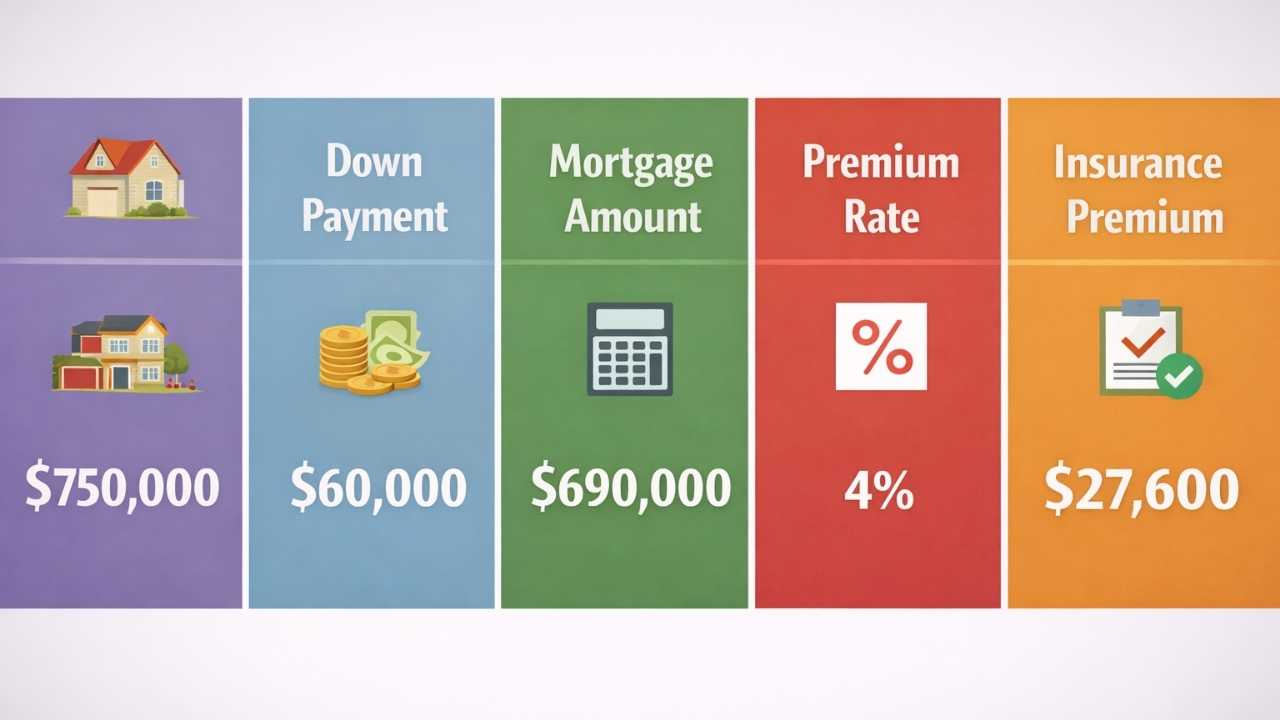

Using the earlier example:

- Purchase price: $750,000

- Down payment: $60,000

- Mortgage amount: $690,000

- Premium rate: 4%

- Insurance premium: $27,600

That premium can be added to your mortgage, so you don’t have to pay it all upfront.

How the premium is paid

Your lender pays the insurance premium to the insurer and then adds it to your mortgage balance. You repay it over the same amortization period as your mortgage.

One thing to note: provincial sales tax on the premium, if applicable, must be paid upfront as part of your closing costs.

What counts as a down payment?

Acceptable down payment sources include:

- Personal savings

- Proceeds from selling a property

- A non-repayable gift from an immediate family member

In some cases, non-traditional sources like unsecured personal loans or unsecured lines of credit may be allowed, but only with strong credit and specific conditions. These situations need careful review.

Credit score and qualification rules

Mortgage loan insurance comes with qualification rules designed to make sure borrowers can manage their payments.

Some key requirements include:

- At least one borrower typically needs a credit score around 680

- Gross debt service ratio generally up to 39%

- Total debt service ratio generally up to 44%

- Maximum amortization of 25 years

- Passing the mortgage stress test

These rules help protect both borrowers and the housing market, especially when interest rates change.

Can you avoid mortgage loan insurance?

The only guaranteed way to avoid mortgage loan insurance is to put down at least 20%.

In rare cases, lenders may still require insurance even with 20% down if a file is considered higher risk. If that happens, alternative lenders may be an option.

If the purchase price is over $1.5 million, mortgage loan insurance is not available, and a 20% down payment is mandatory.

What if you port or switch your mortgage?

If you move homes or switch lenders and your mortgage is already insured, you may be able to port that insurance. This can reduce or eliminate a new premium, depending on the situation and lender.

This is one area where good advice can save you a lot of money.

My Advice for Alberta buyers

Mortgage loan insurance is one of the main reasons homeownership is achievable for many Albertans. While it adds a cost, it often allows buyers to enter the market years earlier than waiting to save 20%.

The key is understanding how it works, how much it costs, and how it fits into your long-term plan.

Every buyer’s situation is different. If you’re unsure how much you need, whether your down payment qualifies, or how insurance affects your mortgage options, getting advice early can make the process much smoother.

If you’re thinking about buying or refinancing in Alberta and want clear, straightforward guidance, I’m always happy to help you understand your options before you make a decision.